What is the chart of accounts?

The chart of accounts sits just under the five main accounts in the general ledger. You can learn more about the main accounts in our chapter on double-entry bookkeeping.

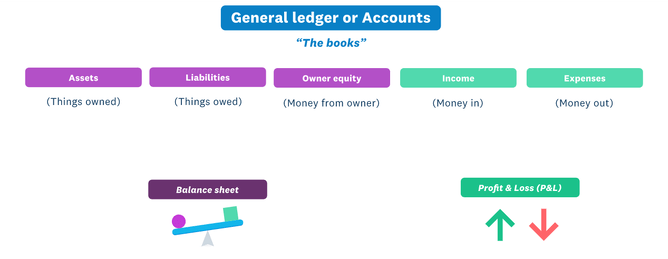

Figure 1, The five main accounts that make up a general ledger.

A business can create as many sub-accounts as it needs to categorise its transactions. However there are some standard accounts that are typically used across most businesses.

What is the purpose of a chart of accounts?

A chart of accounts groups together transactions of a certain type. This allows you to produce detailed reports into specific areas of the business and its finances.

Standard chart of accounts

A standard chart might look like this:

| ASSETS | |

|---|---|

| Cash | Bank account balance, cash |

| Accounts Receivables | Amount owed to the business for product or services performed |

| Prepayments | Amounts paid for goods or services not yet delivered |

| Inventory | Inventory purchased but not yet sold |

| Equipment | Value of Equipment used by the business |

| Vehicles | Value of Vehicles used by the business |

| LIABILITIES | |

|---|---|

| Accounts Payable | Amounts Owed to Suppliers |

| Payroll | Amounts Owed to employees but not yet paid |

| Loan | Amount owed on a business loan |

| Tax | Amount of tax collected but not yet paid |

Liabilities may be organised into current liabilities and non-current liabilities. Current liabilities are amounts owed in the current year. Non-current liabilities are amounts owed next year and beyond.

| SHAREHOLDERS EQUITY | |

|---|---|

| Capital | The Amount the owner has invested into the business |

| Drawings | The Amount the owner has withdrawn for personal use |

| REVENUE | |

|---|---|

| Sales | The amount earned from sale of products or services |

| Other Income | Interest earned on investments |

| EXPENSES | |

|---|---|

| Salaries | The amount paid to employees |

| Supplies | Cost of goods sold |

| Overhead | Rent |

| Utilities | Cost of Power, water, gas |

| Advertising | Cost of advertising |

How is a chart of accounts used in accounting software?

The five core accounts are part of any accounting software and they’re the same for every business. The categories that sit beneath them in the chart of accounts can be customised to suit your business. For example, you might create several accounts for sales revenue – one for each region you trade in, or one for each department of your business.

When you enter a transaction into your software, it may ask you where to record the opposing credit or debit. Or you can teach the software where to make the opposing entry and it will happen automatically.

Edit and import your Chart Of Accounts in Xero

To report on your accounts in a meaningful, accurate way, all your transactions need to be coded to an appropriate account code. It's important to start out with the list of account codes that's right for your business.